At this point, I hope you’re itching to get started on investing! Let’s go 😀

…

But where to?

Different Buckets for Your Dollar

So, in Canada, we have a few important buckets for the dollars that you want to invest.

- Tax Free Savings Account (TFSA)

- Registered Retirement Savings Plan (RRSP)

- Non-Registered Account

(I will go into RESPs in more depth a future post…when I get there myself. My understanding is that this is an account that your kids can really benefit from, and you can sort of benefit from if your kids wind up not pursuing postsecondary education.)

TFSA

What a misnomer. The name makes you think that it’s some of kind of savings account, maybe with a good interest rate.

- (Well, you could open a savings account under the TFSA umbrella…but there is no discernible advantage to doing so that I can see.)

The real beauty of the TFSA lies in the fact that all of your gains in this account will not be taxed.** Everything you make, you get to keep. ALL of it. No matter when or how you take it out.

You might hear people talking about “post-tax dollars” and “pre-tax dollars”. Let’s pivot for a moment and spend some time with this concept.

As a resident, for example, you will get monthly or biweekly pay. The amount that shows up in your mailbox or in your bank account is “post-tax dollars”. It will have some deductions in it that goes toward CPP, possibly your provincial resident association, maybe CMPA fees, maybe more. Taxes should also be deducted from your pay each time you get paid, hence the term “post-tax dollars”.

- This does not preclude you from having to pay taxes when it’s tax time, however. First year is usually exempt based on your previous tax credits from paying so much tuition and not making money. Sometimes second year is exempt. But your third year of residency onward, expect to lose money rather than gain money at tax time…

Whatever money you invest in your TFSA is from your “post-tax dollars”. And whatever your dollar employees in your TFSA make you, you get the keep all of the gains when you withdraw the money. Yay!

“So, how do I go about opening a TFSA, Dr. FIREfly?”

Excellent question!

- Find an online discount brokerage – Questrade is the one I use.

- When opening your account, select “Tax Free Savings Account”

- Start depositing money regularly and in accordance with your strategy – with every paycheque if possible.

- Track how much you put into the TFSA and be sure not to go over your TFSA contribution limit (Hah! If you were on the straight shot path of school-school-school-…-school-medical school-residency and did not receive a lot of financial aid, it will be hard to go over the contribution limit T____T). *Tip: a quick Google search for “TFSA contribution limit year” will show you the total contribution limit in a given year.

** There is one situation in which your gains will be eaten into by tax, called the foreign withholding tax. This is a somewhat more complex notion, however, and I would not worry about it in the beginning stages. The practical takeaway from this is that holding only Canadian ETFs/stocks/bonds/etc. in the TFSA will help mitigate the rather miniscule drag on your portfolio’s growth that is caused by the Withholding Tax. But by doing so, you’re quite possibly going to lose out on a variety of advantages by not having global diversification in your portfolio. Personally, I do still hold ETFs with an international component in my TFSA, and I may eventually pivot them over to the RRSP – when I actually start contributing to it.

On that note, let’s take a look at…

RRSP

Here we have our trusty RRSP. This is a pillar of Canadian retirement investing, having been around since 1957. (The TFSA was conceived in 2008 and came into the world in 2009 – hence the contribution room limit starting in that year).

The RRSP sort of involves “pre-tax” dollars. Here’s what goes on.

When you have a salary, you generate RRSP contribution room. This includes room generated by any previous work you did for which you got a tax slip.

If you don’t contribute (or don’t contribute fully, based on your own RRSP limits) to your RRSP in any given year, this contribution room carries forward in perpetuity. One can build up a lot of contribution room over the years.

If you do contribute to your RRSP, the amount that you contribute in each year is tax deductible, and reduces the amount of income that you would get taxed on in that particular year.

Example: It is 2019. You are an Ontario resident physician. The residency work year starts in July rather in January, but let’s simplify this and just say that your salary for all of 2018 was $65,081.60, and this is the amount that your taxes are based on. You pay $15,859 in taxes, so the amount of money that comes to your hand is $49,222. (We’ll leave out other expenses like CMPA fees, provincial association fees, etc. for simplicity sake).

Let’s say you have never previously contributed to an RRSP in the past. You might have $20,000 of pre-existing contribution room based on previous work you’ve done. Based on how much you made in 2018, you now have an additional $11,714 of contribution room. It’s a lot of room to put money in and invest.

In 2018, you finally felt comfortable enough financially to start investing in your RRSP. You put in $12,000 over the course of the year.

Here’s where the math comes in.

The taxes of $15,859 was based on a salary of $65,081. But by putting $12,000 into an RRSP, you’ve reduced your taxable income to $65,081-$12,000 = $53,081. Therefore, the taxes you really owe the government is not $15,859, it’s less. Now you can invest with $12,000 that you have not (yet) paid taxes on. Eventually, after it’s had time to grow in the RRSP, you will withdraw that money at a lower tax rate than now, thereby keeping more money for yourself.

Sweet!

…Right?

Well, sort of.

Unless your TFSA is full to the brim or you are simultaneously employed somewhere that has RRSP matching from your employer, I would suggest not contributing to your RRSP in medical school and residency, because there is an advantage to building that contribution room for when you are a staff physician.

Why is that?

Because we will be making significantly more money as a staff physician (finally!). And along with significantly more money comes significantly more tax. Fair enough.

Because of Canada’s personal income tax structure (both federal and provincial, although the numbers differ for the two), the amount of tax you pay really increases significantly.

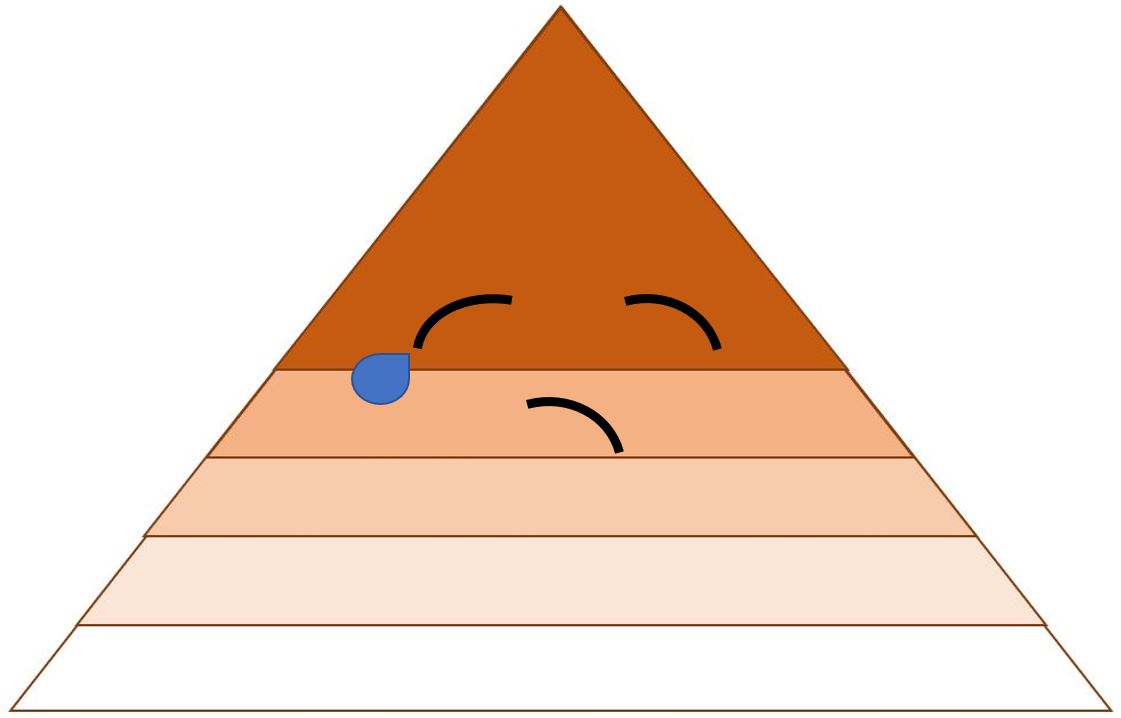

It’s like a pyramid of pain. Behold!

Let’s get acquainted with our pyramid.

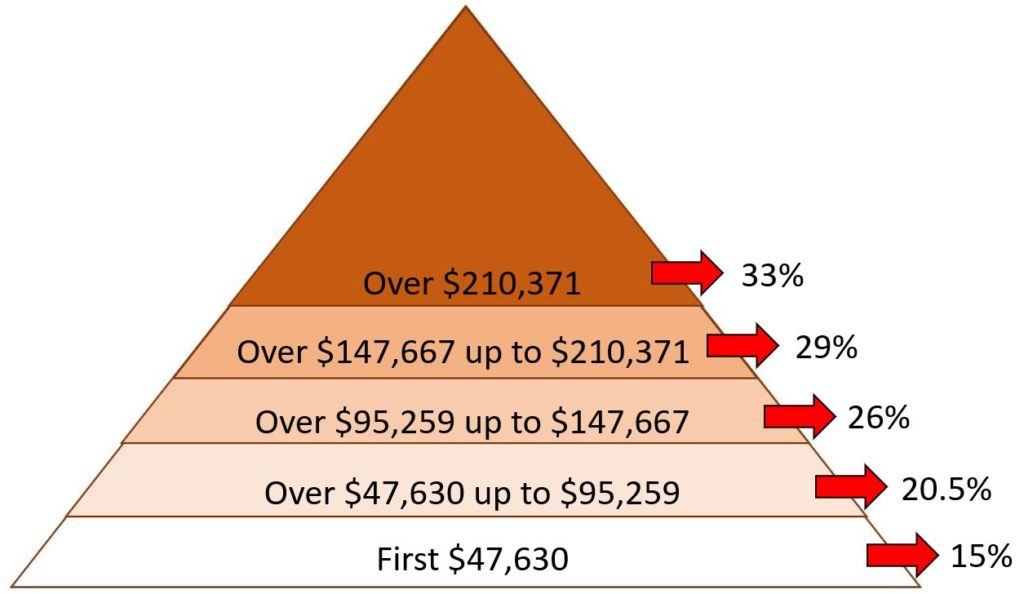

Below is the federal pyramid. You get taxed based on which tier of the pyramid you fall into (more officially known as your “tax bracket”). As you can see, the amount of tax you must pay increases with each tax bracket you are in.

“Fair enough,” you say. “We all gotta do our part to support the government, as they ensure our well being as citizens.”

Agreed.

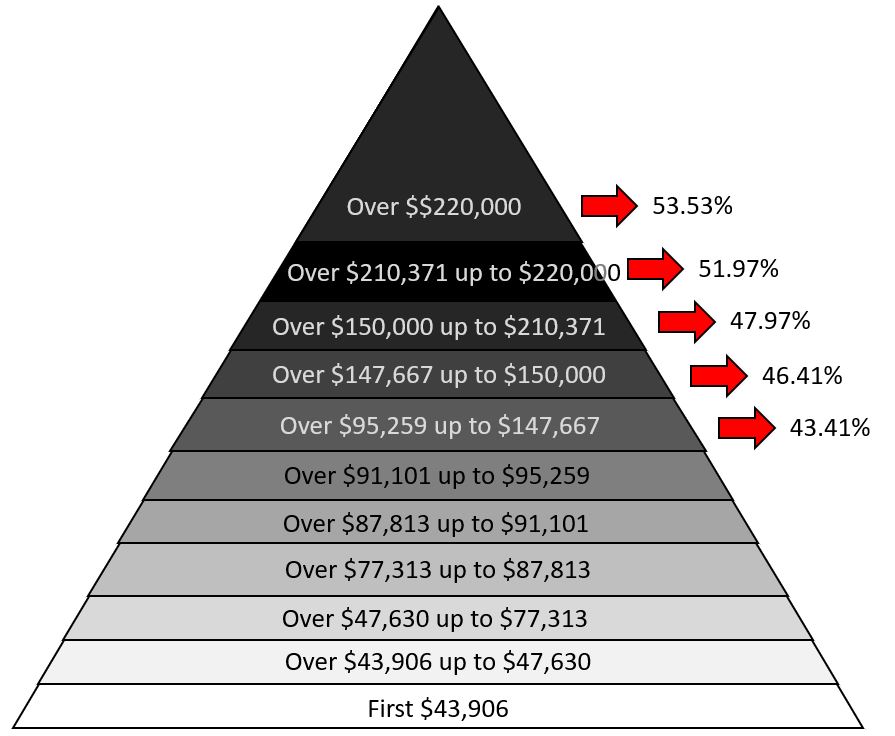

It…doesn’t end there though. Don’t forget, each province also takes its cut.

If we stick with Ontario as the example, we get this multilayered pyramid of pain once we factor in the provincial personal income tax:

I’ve put red arrows where most physicians tend to hang out in terms of income.

So, it’s fantastic that our 10 to 13 years of further education and debt after high school (or more years if you happen to be in field that requires even further subspecialization – hello 17 years more school after high school for cardiac surgery!) gives us higher earning potential.

But the amount of taxes is brutal. And you – unlike some other people your age, who might have pursued very sensible careers like accounting, plumbing, engineering, computer programming, welding, nursing, electrician training, etc. – you have a delayed start on saving and investing. Comparatively, the power of compounding is not in your favour.

Therefore, whatever you can do to minimize the amount of taxes you pay on each hard-earned dollar – my recommendation is to do it. And one of these ways is to leave your RRSP contribution room for when you are a staff physician.

“Okay…I get to decrease how much income I pay on my taxes if I contribute as staff. Is there anything else an RRSP be useful for?”

Excellent question!

Yes.

An RRSP allows you to grow your “pre-tax” dollars and defer paying taxes on them till much later (usually in retirement). The idea is that, when you are retired, your annual salary will be less that what you earn currently.

Why is that?

Because, if you’re on the path to FI, a portion your current earnings are going towards savings and buying that perpetual money making machine that’s going to give you the financial security you seek. Thus, the amount you need to live on comfortably ought to be a fair chunk less that what you’re making.

So, in the interim, your money will be able to grow happily (with the expected fluctuating up and downs) till you need it, and then you’ll be withdrawing the dollars at a lower tax rate. The difference can be huge savings!

P.S. You might have heard about incorporating as a means of minimizing taxes. I have zero real-life experience with this yet, and will direct you to the fantastic posts by The Loonie Doctor and Financially Free MD for more information. Keep your eyes peeled for future posts where I will live-document the process I go through to get incorporated!

Non-Registered Investment Account

This is the last account type through which you can invest. I do not (yet?) have a non-registered account. As far as I can tell, the benefit is that there is no limit on how much money you can invest through this account. The downside is that there are no preferential tax treatments for it. Taxes everywhere!

But. If you’ve got buckets of overflowing money, which is hopefully going to be the case at some point, then this is an account worth considering. I’m being a bit facetious with the drain picture above.

I would maximize the TFSA and RRSP first, however.

A SPECIAL NOTE FOR MEDICAL STUDENTS AND RESIDENTS

Consider starting with a TFSA. There’s lots of contribution room and you can take money out at any point in time without incurring penalties (and the amount you take out gets added to your contribution room the year after, so you get the contribution room back).

With income comes RRSP contribution room. Any RRSP contribution that is not used in a given year can be carried forward. RRSP tax deduction is not particularly useful as a medical student or resident – most will have tax returns for the first year to three years. RRSP tax deduction would be useful in decreasing the amount of personal taxes paid once a staff physician (even if you incorporate).

Overall, my recommendation would be to have the goal of maxing out your TFSA primarily before staffhood, leaving RRSP contribution room for when you are staff. Or at least, this is what I’m currently doing, and the plan moving forward.

A SPECIAL NOTE FOR STAFF PHYSICIANS

Aside from maxing out your RRSP and TFSA if you are not incorporated, I have no other specific advice to offer yet. Despite the recent tax changes, I do think incorporation is still a good idea, unless you are looking at moving – the corporation rules differ by province/territory, and there is some complexity to moving. If you work in multiple provinces/territories, researching how corporation would work in that scenario is also a good idea. Here are some excellent posts from Financially Free MD with regards to incorporation and corporate investing. There is also a wonderful Facebook group dedicated to Canadian physician financial independence that can also provide guidance and a great forum for discussion.

Traditionally, incorporation has been a huge third retirement investment vehicle for physicians (RRSP and TFSA being the first two). It is somewhat unsettling how easily the government can make changes to the parameters of the corporation, whereas the big folks in Ottawa do not seem to touch the RRSP or TFSA as much…maybe? To be honest, the longer the timeline horizon, the more unknown unknowns we are facing. We can only try our best with what we know for know. I’m no policymaker, but I think my approach will be to maximize my TFSA and RRSP yearly first, and then leave the rest in the corporation. Again, I think the approach here will be highly individual!

~~~

Alright, we’ve reached the end of the Basics of Investing mini-series and the Foundations of Finance series! There will be more posts in the future about nitty gritties of each of these components.

As always, these are just the musings of a resident who is in the process of figuring things out, sharing what I’ve learned and done so far. There is a whole world of personal finance out there, and personal finance is, well, personal. What I’m doing may or may not be the right fit for you. Regardless, I hope that these posts have been helpful in some way!

If you have other thoughts, please comment or reach out to me! Would love to hear your thoughts 😊