I think it’s time to talk about potentially enormous wrenches in the FIRE plan. The first of these?

Accruing health concerns over time.

First parents. Then, ourselves.

With regards to parents, I’m not talking about emotionally complicated relationships with parents that might impact how they view or interact with your financial success, although this would certainly be an issue. I’m thinking more specifically of parental aging and health.

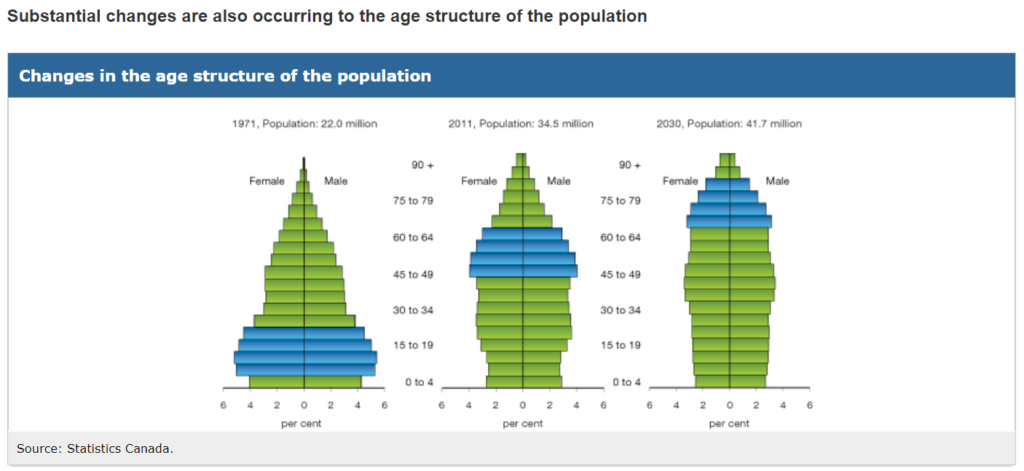

These days, I find myself working mostly with the geriatric population. Although my current patients tend to be seniors (I think the average age of people I’ve seen in the past week has been approximately 85), there is also a lot of interaction with spouses/partners, and adult children. Given the ballooning of Canadian life expectancy over the past few decades, the children of elderly parents are sometimes technically “seniors” themselves. 65 is pretty young these days!

Here’s the rub.

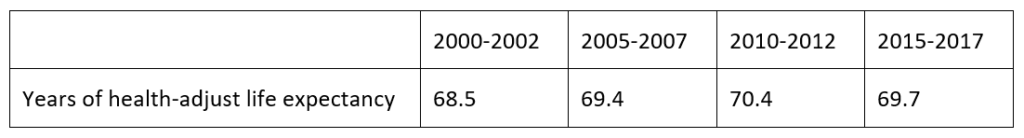

Although life expectancy has increased dramatically over the recent decades, years of illness-free life have not. Pulled from Stats Canada is the measure of health-adjusted life expectancy:

“Health-adjusted life expectancy is the number of years in full health that an individual can expect to live given the current morbidity and mortality conditions. Health-adjusted life expectancy uses the Health Utility Index (HUI) to weigh years lived in good health higher than years lived in poor health. Thus, health-adjusted life expectancy is not only a measure of quantity of life but also a measure of quality of life.” – StatsCan

For all income groups and both sexes, the average number of years of health-adjusted life expectancy looks like this:

My hope is, with greater awareness about the significant quality of life burdens of chronic health conditions – like diabetes, chronic obstructive lung disease (lung cancer is definitely not the only scary possible consequence of smoking), congestive heart failure, dementia, and frailty – the younger cohorts in their 50s and under will be more proactive with prevention. That is the dream – a country of people of all ages who are glowing with health and happiness, vibrancy and productivity, pursuing new passions and paths throughout the lifespan. In terms of seniors, they are the original “FIRE” group. Maybe more… “FIR”? There are many benefits to aging (increasing wisdom and increasing happiness, just to list a couple) – so long as we keep the good physical health to enjoy these benefits.

This still leaves us – anyone under the approximate age of 65 – with the responsibility to care for aging parents who:

- May not have had the benefit of proactive prevention

- May have done all the right things and were just unlucky

- May not have built a sufficient nest egg to take care of health needs that they never anticipated having, because they had not expected to live as long as they do

Let’s walk through some sobering numbers.

Example: heterosexual couple family unit living in Calgary, with one adult child.

Dad is 72. He worked until age 65, and has approximately $2,000.00 per month from his pension. From the Canadian government, he is also entitled to Old Age Security (OAS), Guaranteed Income Supplement (GIS) and Canadian Pension Plan (CPP). The maximum that any individual can get from these in 2019 on a monthly basis is $1,154.58 for CPP (average is $683.65), $613.53 for OAS (maximum amount) and $916.38 for Guaranteed Income Supplement (under very specific circumstances).

Mom is 70 years old and was a homemaker for most of her life. No pension from work, but will be entitled to OAS and CPP.

Dad has not been particularly unhealthy, but does enjoy good food. As a result, he has had dyslipidemia (or blood fat levels that are too high), hypertension (or high blood pressure), and diabetes that were all diagnosed shortly after retirement, at a family doctor appointment that Example Mom dragged him to after 10 years without seeing a physician. So, who knows how long he’s really had the high blood pressure, lipid problems, or diabetes.

5 years ago, you started noticing some changes in him. He didn’t seem as sharp as he used to be. You had to repeat your questions or requests. Then he started getting lost when he left the home, so your mom now watches him carefully. She stopped going to aquacise class or out for coffee with her friends. Her well-being started to deteriorate a bit too.

1 year ago, Dad started getting really irritable. Everyone initially chalked it up to him becoming a crusty old man. But it starts to get more concerning. He’s shouting at Mom for the smallest thing. She’s now both nervous to leave him alone for safety reasons (he left the stove on while making coffee a month ago) and nervous to be around him. At the same time, he’s starting to need to use furniture to support his walking, and he can no longer make heads or tails of the bills – even though this was always part of his household activities. Just last week, you saw him struggle with using the telephone, seeming confused about what to do with it. This is downright concerning.

As a family, you’re finally able to get him to see the family doctor for a second time. The news is in:

Dad has dementia.

He’s started on medications for this. You find out that Mom has been doing a lot more for Dad at home than anyone knew, and she struggling with keeping up physically. You want to move them into a more supported living situation, but in the meantime while you look for private help.

Does this sound familiar at all? If it doesn’t yet, it will. I’m not saying everyone gets dementia. But many, many people start needing help as they age. There are factors within our control to majorly decrease risk of getting dementia, to maintain physical vigour (and avoid frailty with all its consequences), and to maintain overall health – but sometimes things are not in our control.

Even our own health is not fully within our control.

Let alone our parents’ health.

Back to the costs. So, what are we looking at, for Example Mom and Example Dad? A brief scan shows these approximate numbers. (Disclaimer: these are very approximate numbers, pulled from an online and telephone search of Calgary area services.)

And this is not including the cost for various medications that Mom and Dad might be on. While long-term care looks like a great option (given that housing, food, and medical needs are covered) don’t forget the need to qualify (and the bar is getting higher as the population in need grows) as well a potentially significant wait time for placement in long-term care.

Also, with dementia, eventually Mom and Dad might need to live in separate places if the symptom of physical aggression arises. So that would increase the costs.

That’s Mom and Dad. Let’s talk about you. And me.

If we are health-conscious, do all the right things, we might be able to avoid some of those issues above. But lightning strikes anyone, anywhere. Multiple sclerosis? Can happen to anyone. Stroke? Can happen to anyone. Traumatic brain injury, acquired from unfortunately being on the road with an intoxicated driver? Can happen to anyone. Dementia? Still can happen to anyone.

So, we might be looking at these costs for our parents. And, down the road, possibly for ourselves. Or our partners.

Now what kind of FIRE number do you need?

Reverting back to our possible scenario from above, the most financially stressful situation would be to have one parent in a retirement residence and one parent in a private room in a long-term care home. (Otherwise, both would be in a retirement residence together, which would be more than $48,000 but not double).

Assuming the father with dementia lives for 10 years after the diagnosis (the average age of death after diagnosis for Alzheimer-type dementia), and assuming the mother lives till age 85 (which is the life expectancy for a female who is currently 65 years old in Canada), then you’re looking the following math:

Example Father: $36,000 per year x 10 years = $360,000.

Dad can pay, at maximum, $2000 (from pension) + [$613.53 + $551.63] (OAS and GIS) + $683.65 (average CPP) = $3,848.81 per month = $46,185.72 per year.

This leaves Example Adult Child with $360,000 – $46,185.72 = $313,814.28 to pay over 10 years, or $2,615.12 per month.

Example Mother (assuming age 70): $48,000 per year x 15 years = $720,000

Mom can pay, at maximum, [$613.53 + $551.63] (OAS and GIS) for ten years, after which she is widowed and can pay, at maximum, [$613.53 + $916.38] (OAS and GIS) for the next five years = $11,652.60 + $7,646.90 = $19,299.50.

This leaves Example Adult Child with $720,000 – $19,299.50 = $700,700.50 to pay over 15 years, or $3,892.78 per month.

Total = $1,014,514.78.

The math gets a little bit beyond me at this point with regards to optimizing for the cost over the first 10 years (which bill be the most expensive period) vs. the cost over the last 5 years of the 15 year span.

But, if we make a bunch of assumptions (parents have no savings whatsoever, that both parents live the average amount of time expected, and need lots of care, Dad gets into long term care right away, and the dollar amounts are frozen in 2019 terms forever), Example Adult Child would be wise to have another 1 million dollars stashed away to pay for parental care.

Okay, that is really depressing. On multiple levels. And I did not factor in accounting for Example Adult Child’s own or partner’s possible future health needs. *sigh*

Again, there were a lot of assumptions made in the Example family scenario above.

Here’s the bright side.

- I did not factor in the asset of the original residence of Example Parents. The sale of this home could help quite a bit in offsetting other costs.

- Your parents’ health situation might be better than Example Parents’.

- Both parents could be pulling in pension.

- Pension(s) could be higher than Example Dad’s pension. (But bear in mind OAS and GIS amounts will go down after certain income thresholds).

- Parents might have savings.

Other ways to mitigate the larger FIRE number needed is to pull back to part-time work (either in the current field or working in a different field altogether). Even minimal part time work would be able to help offset the cost immensely. The monthly projected parental care expenses for the first 10 years would be $6,507.90. Being able to generate $2,200.00 per month after tax would cut the 1 million down by more than a third. Being able to generate $3,250.00 per month after tax would cut the 1 million down by half.

You know, this is the second time I’ve tried the write this post. The first time was too depressing, and then I got side tracked by this great post about living on a cruise ship full time instead in assisted living, provided your health – and finances, of course – are good enough. (Sadly, Mr. Sparks was not keen on the idea. He likes having a home base.)

These are serious considerations for anyone considering FIRE, though.

I love the FIRE acronym – so catchy! – but there are a lot of good reasons to pursue FI, rather than FIRE. Loving the essence of your work is one good reason (either the work you do now or one that you intend to pursue after pivoting fields). I’d count parents accruing health problems over time as another one. Hopefully your folks are like mine and happily rather healthy right now (though mine not completely free of vascular risk factors). I know many people would not hesitate to bankrupt themselves to ensure that their parents’ later years are spent in comfort and contentment, and count myself among those people.

Of course, let’s not bankrupt ourselves at all, if possible.

Time to re-evaluate the FI number.

-Dr. FIREfly

Hey FF,

Excellent post.

I have been taking care of my parents’ housing costs since I was 25 years old. For myself, it is just a way of life by this point.

My parents do their part by keeping themselves healthy. But life does throw curveballs and no one is immune.

FI is a great goal whether one RE or not.

Much like I do not believe in private school, I would not support high end care homes either. No one needs that.

If one wants it, make sure to have the resources ready to pay it yourself. And if that takes all your wealth than so be it. That’s an individuals choice.

Your adult children are hopefully not waiting for a huge inheritance. If they are, you have failed somewhere as a parent. That alone should be depressing enough.

Thanks for the comment, Dr. MB!

Yeah, the high end care homes is interesting. The trickiest part is that the glossy surface does not seem to equate consistently with good care. In fact, they seem to be completely independent variables. One would expect better care with a higher price tag, but alas… The publicly funded long term care homes seem to have better trained staff, tbh.

The adult children hopefully not waiting for a huge inheritance is interesting. Right now, my gut reaction is to say, “100% in agreement!” There are likely cases where, just depending on how the cards fall, they might be waiting for an inheritance that can make a big difference. The hope would be that parents and children have each done the best they can throughout the years to *try* to ensure that the adult children don’t find themselves in that position.