They say you can never time the market. (I’d add that this is one of the rare instances when “they” are correct).

I and the rest of investors have been extremely lucky with the past bull market run. When I started investing back in PGY 1 (and then PGY 2 for reals), I really was expecting a market downturn at some point during residency. Barring a few short blips, this hasn’t happened yet.

Boring investor disclaimer, by the way. My portfolio consists of ETFs (Canadian, U.S., and international) and one REIT. My math skills are also not superlative, so I keep it simple when I track how things are going.

I was plonking in my numbers on pay day (whooo!) when I realized what numbers I was staring at.

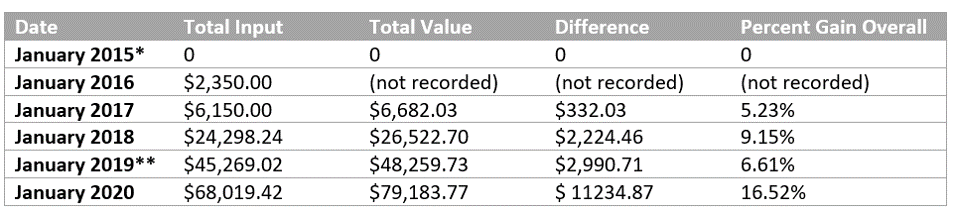

So. Here’s one tale of how investing in residency can go:

*Yeah, still in medical school at this time, sweating bullets during CaRMS but having a blast seeing fellow classmates on planes and randomly in airports. No income.

**This one is technically a couple days into February, as I did not record total value or difference for the last January deposit of 2019

So…yeah. Since the inception of this account, it has made $11,234.87 without me lifting a finger. That is the equivalent of just over 100 call shifts – except, without doing the grueling overnights (and often into the next morning) wherein you may or not have time to eat (supper, midnight snack, or breakfast – hah, who eats breakfast on call) or sometimes even use the bathroom (thank goodness my residency program is more humane, but this is not unheard of),. This is also the equivalent of between 1.5 to 2.5 months’ work depending on residency year or province – except, without doing the work.

Of course, in the eventuality of a big market change for the worse, these number could temporarily go “poof”! (Indeed, I “lost” $1,000.00 between mid-January and end of January in terms of portfolio value) But the underlying value of holding shares in various markets is still there.

Staff physician readers of this post may chuckle at what I’m about to say next. But really…

…

I feel rich!!!

So yeah. That’s all I wanted to say.

Now imagine if one had taken the same investing trajectory and started residency in the middle of a market downturn or crash.

I would never wish for a market downturn/correction or crash given the significant human costs and wider politico-socioeconomic ramifications, but history indicates that they come regardless of our wishes.

Let’s keep our eyes peeled, spending in line, be buffered against emergencies and ready to dive in when it does come.

-Dr. FIREfly

Congrats. Avoiding further debt growth during residency, getting into the habit of investing regularly, and gaining the experience of simple low-cost DIY investing are really the biggest financial health goals during residency. You’ve demonstrated that it is readily achievable and I hope that inspires others.

-LD

Thanks, Loonie Doc! I’ve been slowly trying to spread the word in real life too. Always interesting to find people who are already on the path and are hungry for more info, or who are intrigued by these “new” concepts. Maybe we can eventually incorporate physician personal finance in medical trainee curriculums. I know if I ever wind up in an academic centre, this would be an initiative to pursue!