What is the basic concept of Lifecycle investing? In a nutshell:

- Borrow money (leverage) to invest early on

- Pay off the borrowed money bit by bit over time

The idea is to do this instead of putting money into the market bit by bit over time.

…Why?

If you think of your future portfolio like you would think of a home, this course of action is like taking out a mortgage on your future portfolio. “Borrow a large amount early and slowly pay it off in order to have the same amount invested every year.” – Ed Rempel, fee-only financial advisor who is well known in the Canadian FI/RE circles.

It actually makes sense. I have thought about doing this for a while. In fact, I nearly “panic-bought” more ETFs in the spring with borrowed money when the whole market went down, but I hadn’t had enough time to look into the concept of borrowing to invest, and decided not to let emotions run the show.

Ultimately, after a period of consideration, I took the plunge this past fall.

This post will look at the theory behind why. If you want to go straight to my story, it can be found in the next post.

Why Borrow to Invest

Let’s go back to the concept of taking out a mortgage on your future portfolio.

Why not just invest the old-fashioned way – putting money every month (or every two weeks) into the TFSA/RRSP and build up assets over time?

This is a trick question. Here’s the two-part answer.

- I would not borrow money to put into a TFSA or an RRSP – I use my own money for that. I would borrow money to put in a non-registered account and buy investments there. We’ll discuss why in a second.

- There are downsides to doing things the old-fashioned way.

Downside to Building Up Assets Bit by Bit

Let’s picture investing over a 30-year period. Say you put in $1,000 every month in the first years of residency, put in an average of $2,500 a month in your first year of practice due to lost income from medical practice setup fees and early mistakes with billing, and then put in $5,000 a month afterward till retirement. (These numbers are arbitrary, and should not be used as a benchmark for how you’re doing financially).

With the effects of compounding over time, and the fact that you’re putting money into the market a bit at a time, the time point at which you will have the most money in the market is right before you retire.

But what if the markets do poorly in the last ten years before retirement? What impact would that have on your final portfolio?

Let’s borrow Ed Rempel’s hypothetical person’s numbers. (This person’s name is Robert.)

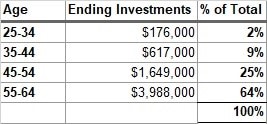

Table 1: Robert invests $10,000 into his RRSP per year and increases that by inflation every year.

To walk through this table verbally, here’s what we’re looking at: Robert starts investing $10,000 a year at the age of 25. It’s sort of 10,000 a year – the amount invested increases in pace with inflation. We are also assuming a market return of 8% per year, with compounding interest happening as well.

The middle column shows how much money Robert has in his RRSP at the end of each decade, after the RRSP contribution and compounding interest.

The right column shows what percentage of his lifetime portfolio Robert has invested at the end of each decade. So, Robert owns $3,988,000.00 in investments by the time he reaches traditional retirement age at 65 years old. During the decade of age 25 to age 34, he owns only 2% of that total lifetime portfolio. During the decade of age 55 to age 64, he owns 64% of that total lifetime portfolio. If you add up some of the percentages, Robert owns 89% of his total assets only in the last two decades of his portfolio building period.

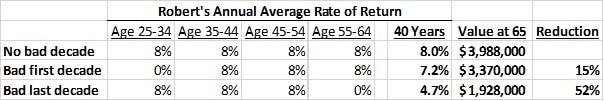

Because the vast majority of owning his assets comes later in the investment lifetime, the returns of each decade of investment would have a significant impact on the portfolio’s lifetime yield. This is illustrated below in Table 2.

Table 2: The effects of having bad returns in different decades on total portfolio amount at the end of it all.

In essence, if the last decade of investing was a decade with a bad average annual rate of return, his end portfolio value would be reduced by basically half! This is the “last decade risk”.

Well that stinks.

And there’s no way to predict which decades are going to be good or bad.

Lifecycle investing helps mitigate that risk.

You take out a mortgage on your future portfolio earlier on in life. You hold more of those assets earlier in life. They get more time to gain returns through “good” markets and “bad”, and are at less of risk of being exposed only to “bad” return years because they’re around for longer.

Turns out Lifecycle investing works 100% of the time for anyone retiring in the last 96 years. This includes some extremely bad markets, like the Great Depression. 100% is impressive.

Ed Rempel does a stellar job at breaking this concept down in detail in his great article, which is also the source of these tables.

Benefits of Leveraging to Invest

Let’s come back to the earlier statement of not borrowing and investing in a TFSA or RRSP, but rather, putting the borrowed money in a non-registered account.

The reason is: if you borrow money to invest in an asset that has a reasonable expectation of generating income, the interest incurred on the borrowed money is tax deductible. And this only works in a non-registered account.

For people in medicine, there is a neat loan source available – the professional line of credit. As of the time of writing this article, the interest rate on the professional LoC is 2.20% This is comparable to mortgages, the interest rate is so low.

Here’s a hypothetical situation:

Medical student/Resident (MS-R) borrows $350,000 at 2.20%, and wants to pay it down (“amortized”) over 30 years:

- The total amount of interest paid would be $128,423.*

- The total amount of payments paid would be $478,423.*

- Monthly payment= $ 1,328.95, yearly = $15,947.40*

- Monthly interest payments = $356.73, yearly = $4,280.76*

$4,280.76 would then be deducted from MS-R’s annual personal taxable income.

Less personal taxable income means less taxes owed to the government.

Benefits summary:

- Mitigate timing risk for investments

- More time for more money to be compounding

- The interest paid on the borrowed money is tax deductible

Risks of Leveraging to Invest

How much of the last decade risk can be mitigated?

It’s all well and good to borrow up to $350,000 (the usual current maximum line of credit limit) to invest. But that number is (hopefully) not the lion’s portion of your future total portfolio amount. So really, how much of the last decade risk is being mitigated by using the line of credit in this manner?

Also, if you are looking at a shortened time trajectory for FI+RE, the impact of leveraging may be less, depending on where you are in the FIRE journey.

Cash flow

Not to mention, borrowing $350,000 and needing to pay $1,328.95 every month to service/pay down that debt can be a lot for a resident to pay back. And most medical students are not making much (if any) income in medical school.

Drag from interest, counter-drag from tax deduction

The market return gains from leveraging to invest early are detracted from by the interest you pay on the loan. But then there are also the tax deductions to consider. This math is worth working through to see if leveraging is worth it. So long as interest rates on the loan are below reasonable market returns (which, I would estimate on a very conservative end at 6% averaged out over many years), the math is easy. If the interest rate on the loan is the same as market returns, you still have the benefit of the tax deductions, but we are getting closer to an equilibrium point where it may or may not be worth the risk of being leveraged – depending on your risk tolerance.

Interest rates can change

The numbers for the hypothetical situation with MS-R above are calculated based on a fixed interest rate. This is not a safe assumption, however – interest rates can change. I would recommend building in a lot of wiggle room, and running the same numbers again with the higher interest rate. Refer to this table for rates over the past 13 years.

It is worth reassessing, as interest rates change, whether it is still worth it to continue the leveraged position. Most likely, interest rates should not rise to the point where they outweigh the benefit of leveraging any time soon. But we are holding this position for the long term.

Insufficient risk tolerance

The investor is also assuming that they will have the gut fortitude and cash flow to hold onto their investments during downturns and not sell. People tend to feel quite confident in good times. We truly do not know how we will fare in a crisis until we are in that crisis. Some people make an investor policy to help keep themselves on track during the crisis. It is a set of guiding investing principles, which helps them acknowledge their emotions, and then act based on decisions made in less emotional times.

Next post will be a mini-case study of how I got into Lifecycle investing, my specific assumptions, and the risks and benefits that I weighed in making the decision.

Until next time!

-Dr. FIREfly

Great blog post! LOC Is an under appreciated asset for trainees, especially given cushion for relative job security and high earning potential ahead of them. Just wondering you if could do a future post going into the details of claiming leveraged LOC interest on your taxes.

Thanks Mark! That’s a great idea for a blog post. I might just take up your idea, as tax season starts to draw closer…

Pingback: Graduating from Residency with a CoastFI Amount Invested - Dr. FIREfly