Despite living in Canada, where we have universal healthcare, it is still worth considering what costs might need to be footed out of pocket. Because there is a fair amount that is not covered by our “universal” healthcare, despite what the terminology might initially lead you to think.

The unsexy bottom line is…you need health insurance. What each person will want to have covered will vary depending on your level of caution and personal/family history.

But get health insurance.

In More Depth…

It can be strange as a healthcare provider to consider healthcare from the other perspective. Some of us, from various trainee stages up to staffhood, may be lucky enough to not have had much interaction with the healthcare system from the patient or family member end.

For someone planning out financial independence +/- early retirement, it is worth thinking about what costs might come your way, especially if you do not have healthcare coverage through work/retirement benefits.

Compared to our neighbours south of the border, healthcare expenses are a much smaller consideration in the overall financial picture in Canada, especially for people without chronic health conditions. Our healthcare system covers many costs. Many, many costs.

But not all.

And some of those costs might still break the bank.

Covered

- Hospitalization – room, food, medications, procedures, medically-indicated surgeries, in-hospital equipment, etc. (private rooms cost extra though)

- Maternal care

- Physician visits (e.g. family practice, specialist clinic, office procedures). However, there are private options now as well, where a patient might pay for ancillary services.

Not Covered or Partially Covered

- Prescription medications

- Home care

- Long term care

- Dental care

- Vision care (by optometrists)

- Psychotherapy (unless provided by an MD physician)

- Fertility treatments (except in Quebec – fully covered)

- Cosmetic surgery

- Some elective surgeries

- Medical assistive devices (e.g. wheelchairs)

There are some exceptions (e.g. based on age and indigenous status) that are beyond the scope of this post.

Scenarios in Which Healthcare Breaks Your Bank

Any of those not-covered or partially covered costs could potentially pull your savings into an infinite black hole.

Expensive Medication Needs

“Ah, who cares. I’ll just choose not to go on the expensive medications.”

Well. You might say no to expensive medications for yourself.

Would you say no to expensive medications for your child, if it could make a difference in their longevity or quality of life? Would you say no to expensive medications for your partner, for your parents?

The amount of money that people directly spend on healthcare has only increased over time, the largest categories in this spending bring drugs (33%) and non-physician healthcare professionals (33%).

In 2017, out-of-pocket health spending was over $970 per person. This is much increased from the 1988 amount of $278. Using this inflation calculator, $273 in 1988 is worth $503.71 in 2019. So, the rise in cost cannot be accounted for by inflation alone. Per person, drugs were $682 on average, other professionals: $684 (Canadian Institute for Health Information. Health Expenditures in the Private Sector — Private-Sector Chartbook, 2019. Ottawa, ON: CIHI; 2019.)

$682? In a year? Meh. (Bear it mind that this is the average – which means some people spend a lot more than $682, and some people spend $0. We don’t know what the spread of numbers is, that gave this average.)

To continue – $682 in a year, on average doesn’t sound too bad.

But here are some sobering figures.

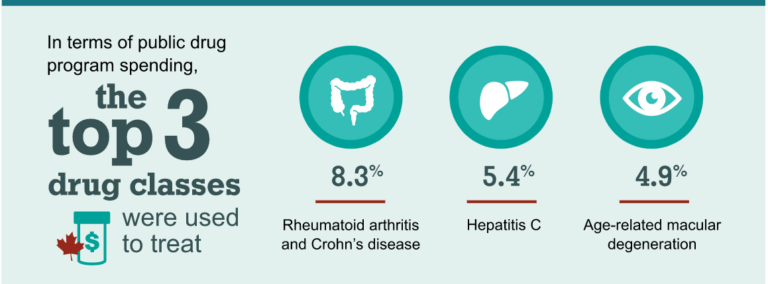

Canadian Institute for Health Information (CIHI) data from 2018:

“Almost 40% of public drug dollars were spent on just 2% of beneficiaries. 3 out of 5 of these individuals used a drug therapy that cost $10,000 or more per year, most often an antiviral to treat hepatitis C or a biologic to treat conditions like rheumatoid arthritis and Crohn’s disease.” – CIHI.

- To clarify, these public drug dollars refer to provincial health programs (e.g. OHIP, PharmaCare, etc.) for outpatients, and does not include drugs given in hospital.

The top drug classes by rate and use of total program spending show that tumour necrosis factor alpha (TNF-a) inhibitors (which are among the treatments used for rheumatoid arthritis and Crohn’s disease) were the drugs that incurred the highest total program spending in 2017 at a total of $1,105,266,000.00 for 57,741 people. Doing some math here, that equates to a whopping $19,141.79 per person in that year.

Let’s pause for a second.

$19,141.79 is a staggering annual sum to spend on medications. This is the worst-case scenario.

- Not everyone who gets rheumatoid arthritis or Crohn’s disease needs to be on TNF-a inhibitors.

- And even if you do need TNF-a inhibitors or any of the other colossally expensive medications, across medical fields, physicians go through all sorts of creative means to try to get medications covered if patients can’t afford them.

So, I’m not saying that you should get health insurance because if you don’t, you will be hammered by a $19,000 a year bill. It’s possible that this could happen, but it’s also quite possible there might be some paperwork wrestling that your doc can do to help you out.

Even still, there are in-between costs that can be relatively expensive, still hurt quite a bit, and you would be better off having health insurance in the first place to cover them.

Solution: Make sure you have good health insurance.

- For medical students, usually there are inexpensive options available through the provincial health association. I seem to recall this being the cheapest option, but it has been a while since I was in medical school.

- For resident physicians, usually there is coverage through the provincial resident association. Take a look in your last year of training as to what options are available out there for once you become a staff physician. Because as a staff physician, you are on your own, an independent contractor with no protection from a workplace health plan.

- If you are already a staff physician – or any other kind of private contractor or part-time employee without health insurance – I would suggest looking into it ASAP. Provincial medical association is a good place to start, and then maybe having two or three other options to compare to.

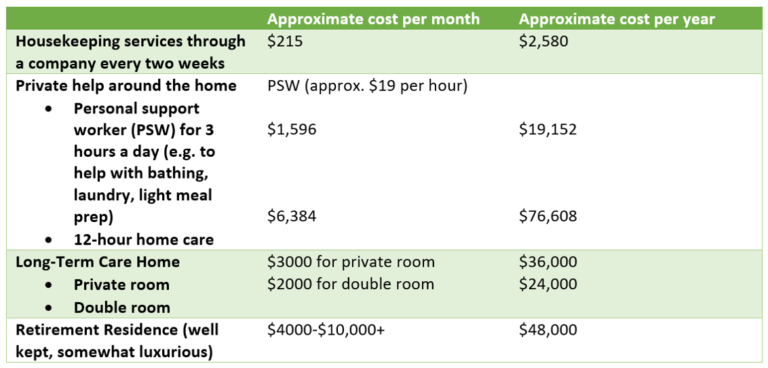

Long Term Care and Home Care

- For your family members

- For yourself

I wrote a detailed post about potential costs here. For convenience, however, I have pulled the summary table into this post here:

Ouch.

Other expenses can be expensive one-time or few-times needs (e.g. dental, fertility treatments), but not continue for a very long time. Medications, and long-term care though?

In Conclusion

Back to the unsexy bottom line.

You need health insurance.

The specifics of the insurance will vary depending on what you perceive your needs to be based on your level of caution and personal/family history.

But get health insurance.

And make sure medications are covered.

-Dr. FIREfly